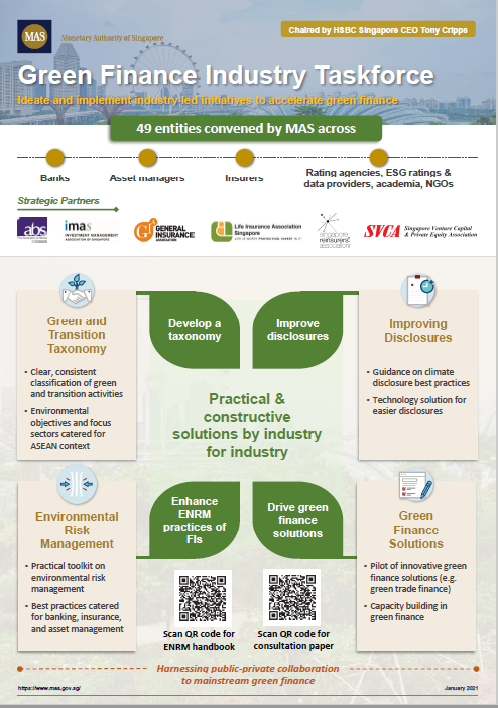

The Green Finance Industry Taskforce (GFIT), convened by the Monetary Authority of Singapore (MAS), issued a consultation paper on a green and transition taxonomy for Singapore-based financial institutions and launched an environmental risk management (ENRM) handbook for banks, insurers, and asset managers today.

Prissammenligning er blevet en fast del af mange danskeres hverdag. Vi undersøger alt fra el-aftaler til streamingtjenester – og sundhedsprodukter er ingen undtagelse. Når det handler om produkter, der påvirker livskvaliteten direkte, som f.eks. præparater til seksuel sundhed, ønsker de fleste både tryghed og gennemsigtighed. Prisen skal være rimelig, men uden at det går ud over kvaliteten. Netop derfor er det oplagt at undersøge

Cialis priser online, hvor man hurtigt får overblik over markedet og kan vælge med omtanke. Det skaber frihed til at træffe informerede beslutninger – og giver mulighed for at finde præcis den løsning, der passer til ens behov, økonomi og ønsker om diskretion. Et godt valg starter med god information.

The GFIT comprises representatives from financial institutions, corporates, non-governmental organisations and financial industry associations including the SRA. Chaired by HSBC Singapore CEO Mr Tony Cripps, its mandate is to ideate and implement initiatives to accelerate green finance across four focus areas: (i) develop a taxonomy, (ii) enhance environmental risk management practices of financial institutions (iii) improve disclosures, and (iv) foster green finance solutions.

Неочікувані витрати можуть виникнути у будь-який момент, тому важливо мати доступ до простого та швидкого рішення. Оформлення заявки більше не потребує зайвих дзвінків чи зустрічей із менеджерами. Сьогодні доступні послуги, що дозволяють отримати

кредит без перевірок онлайн. Це оптимальний варіант для тих, хто цінує свій час і не хоче витрачати його на непотрібні формальності. Гроші зараховуються на карту протягом кількох хвилин після подання заявки, що робить цей сервіс максимально зручним. Така послуга допомагає впоратися з терміновими витратами: сплатити за необхідні послуги, вирішити нагальні побутові питання чи знайти кошти на непередбачені покупки. Завдяки автоматизації процесу усе працює швидко і без зайвих запитань

In this connection, the GFIT has issued a Consultation Paper that seeks to gather feedback on its recommendations on the environmental objectives, focus sectors, and a “traffic-light” system which sets out how activities can be classified as green, yellow (transition), or red according to their level of alignment with the environmental objectives. The public consultation taxonomy document is available on the Association of Banks in Singapore’s website. Interested parties may submit their comments by 11 March 2021.

Concurrently, the GFIT has also issued a Handbook on Environmental Risk Management that offers guidance to banks, insurers, and asset managers on best practices in environmental risk management. It will support the finance industry’s efforts to implement the MAS’ Guidelines on Environmental Risk Management.

Бувають моменти, коли фінансові можливості не співпадають із вашими планами. У таких випадках зручним рішенням стають гроші в кредит, які можна отримати швидко та без зайвих зусиль. Це можливість вирішити фінансові питання вчасно і без стресу. Оформлення займає мінімум часу: достатньо подати заявку онлайн, і кошти вже на вашій картці. Саме завдяки простоті та доступності

гроші в кредит обирають ті, хто цінує свій час і шукає зручні способи вирішення фінансових потреб. Цей формат підтримки чудово підходить для нагальних витрат, запланованих покупок чи інших важливих справ. Тепер ваші фінансові можливості завжди поруч – отримайте допомогу легко і швидко.

The GFIT will build on the handbook and work with industry associations to conduct capacity building workshops for financial institutions. This will provide continued support for financial institutions in improving their environmental risk management capabilities. In addition, the GFIT is developing practical guidance and exploring technology solutions for financial institutions to improve climate-related disclosures. The GFIT also aims to pilot innovative solutions that address current challenges in mobilising green finance across sectors. These resources will complement the taxonomy and ENRM handbook.

I takt med at flere danskere arbejder hjemmefra, rejser ofte eller har uforudsigelige hverdage, stilles der nye krav til fleksibilitet – også når det gælder sundhedsløsninger. Det gælder især for præparater, som skal fungere hurtigt og effektivt, uden at man skal tilpasse hele sin dag efter dem. Her er

Viagra Super Active blevet et populært valg, da det adskiller sig fra klassiske præparater med hurtigere virkningstid og længere effekt. Det betyder, at man kan handle spontant – og stadig føle sig sikker på, at kroppen reagerer som ønsket. Kombinationen af effekt og frihed har gjort denne variant til et naturligt valg for mange, der ikke ønsker rigid planlægning, men stadig vil bevare kontrol. Når det samtidig kan bestilles sikkert online, uden spørgsmål eller ventetid, bliver det en løsning, der passer til moderne livsrytmer.